san bernardino tax collector property taxes

We will help complete the form. Make checkmoney order payable to SF Tax Collector.

San Bernardino County S Auditor Controller Treasurer Tax Collector Where Do My Property Tax Dollars Go

Deposits are no longer being accepted.

. She is a California-licensed CPA with over 18 years of professional experience in accounting auditing and management. Find San Bernardino Online Property Taxes Info From 2022. The Assessors new Parcel Access application provides.

Linda Santillano has served as Property Tax Division chief since October 2017. San Bernardino County has one of the highest median property taxes in the United States and is ranked 445th of the 3143 counties in order of. The canceled checkmoney order stub serves as your receipt.

222 West Hospitality Lane San Bernardino CA 92415 Assessor Services. San Bernardino Treasurer-Tax Collector mails out original Secured property tax bills in October every year. And applying all legal exemptions.

Dan McAllister Treasurer-Tax Collector San Diego County Admin. The deadline was 500 PM Pacific Time on May 6. Assessor-Recorder-County Clerk Rolls Out Mobile Unit RV for Increased Services.

Office of the Treasurer Tax Collector. Assessor Oil and Dissolved Gas Production Report. The second installment is due on February 1.

Assessor BOE-566-D Oil and Gas Operating Expense Data. Listing all assessed values on the assessment roll. 909 387-8307 Recorder-Clerk Services.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. The median property tax in San Bernardino County California is 1997 per year for a home worth the median value of 319000. She joined ATC in 2005 and held various positions in the Internal Audits and Property Tax Divisions prior to promoting to her current post.

The market value of the property has grown to 250000. The maximum amount the property could be assessed under proposition 13 is 204000 200000 2. Chief Deputy Tax Collector.

Assessor BOE-566-K Oil Gas and Geothermal Personal Property Statement. San Bernardino County collects on average 063 of a propertys assessed fair market value as property tax. Degree in Business Administration with a concentration in Accounting from California State University San.

Do not send cash. Bidders with a valid deposit may submit bids starting on May 14 at 800 am Pacific Time. Mikulski began her position as the ATC Chief Deputy Tax Collector in November 2021.

Property Reports for Real Estate Pros Developers Investors Appraisers Agents. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. Center 1600 Pacific Hwy Room 162 San Diego CA 92101.

The Assessor is responsible for locating describing and identifying ownership of all property within the County of San Bernardino. Assistance Completing the Form. She most recently worked in healthcare finance and has extensive knowledge in accounting.

Ad Professional-Grade Home AssessmentsGet the Tools Data Resources You Need Today. The San Bernardino County California online Tax-Defaulted Property Sale will take place May 14-May 20. Initial base year value.

The final payment deadline is December 10. Notification to the Assessor of Business in San Bernardino County. The final payment deadline is April 10.

If needed request an appointment to come into the office at 222 W Hospitality Lane 4th floor San Bernardino CA 92415. Establishing an assessed value for all properties subject to taxation. 909 387-8307 Recorder-Clerk Services.

Supplemental Roll 125 Signed and Delivered. 2021 San Bernardino County Property Assessment Roll Surpasses Quarter of a Trillion in Value. Supplemental Assessment Roll 124 Signed and Delivered.

The San Bernardino County Assessor provides several options for filing Business Property Statements 571-L. In year 1 the subject property was purchased transferred for 200000 and the Assessor enrolled that amount as the base year value. 222 West Hospitality Lane San Bernardino CA 92415 Assessor Services.

571-L Instructions Filing Options and Forms Due Date April 1Penalty Date May 7 If May 7th falls on a weekend or legal holiday the property statement may be filed or mailed and postmarked on the next business day. A 10 penalty will be added if not paid as of 500 pm. She holds a BS.

The first installment is due on November 1. Include Block and Lot number on memo line. Contact our office at 909-382-3220 for help.

Assessor Dutton Highlights Business Property Statement Filing Extension San Bernardino County Assessor Recorder Clerk

San Bernardino County Ca Property Tax Search And Records Propertyshark

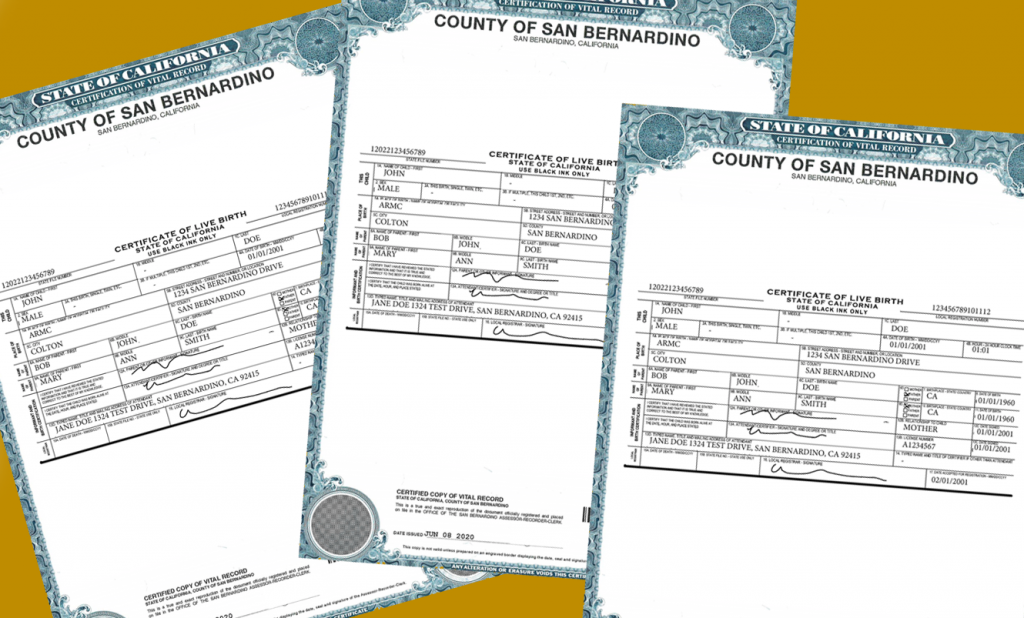

California Public Records Public Records California Records

San Bernardino County Auditor Controller Treasurer Tax Collector Facebook

Faq Archive San Bernardino County Assessor Recorder Clerk

San Bernardino County Ca Property Tax Search And Records Propertyshark

San Bernardino County Ca Property Tax Search And Records Propertyshark

Transitional Assistance Department County Of San Bernardino Countywire

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

San Bernardino County Property Tax Assessor And Tax Collector

San Bernardino County Auditor Controller Treasurer Tax Collector Atc Ensen Mason Today Encouraged Property Owners To Pay The Second Installment Of Their Property Taxes By Monday April 12 To Avoid A 10 Penalty The Tax

San Bernardino County Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

San Bernardino County S Auditor Controller Treasurer Tax Collector Where Do My Property Tax Dollars Go

Deadline Approaching To File A Claim For Unclaimed Property Tax Refund County Of San Bernardino Countywire

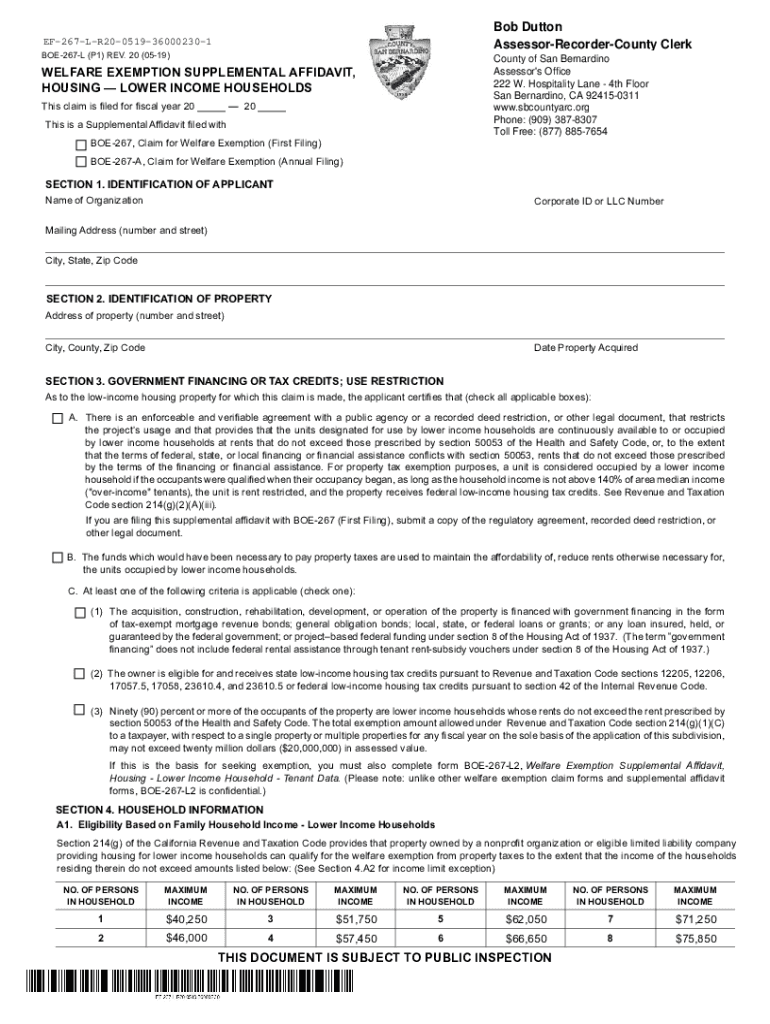

Ca San Bernardino Boe 267 L 2020 2022 Fill Out Tax Template Online Us Legal Forms

San Bernardino County Auditor Controller Treasurer Tax Collector Facebook

San Bernardino County Assessor Recorder Clerk Office Of Bob Dutton